Following the recent U.S. presidential election on November 5, financial markets are reacting to potential shifts in economic and regulatory policies under the new administration. October labour market data revealed modest gains, with nonfarm payroll employment rising by 12,000 jobs, keeping the unemployment rate at 4.1%. Healthcare and government sectors saw slight improvements, while temporary help services and manufacturing continued to struggle, partly due to ongoing strike activities. Additionally, Hurricanes Helene and Milton caused disruptions across the southeastern U.S., impacting employment figures and market sentiment.

Following the data release, the dollar saw a minor decline of 0.35%, while major stock indices and cryptocurrencies showed signs of recovery. With the Federal Reserve's anticipated rate cuts likely beginning in early 2025, markets are already adjusting in expectation of a 25-basis-point reduction at the upcoming meetings. The economic policies of the newly elected administration will be crucial in determining the trajectory of these anticipated rate changes and overall market stability.

EUR/USD

The EUR/USD pair has experienced a downward trend, influenced by the U.S. dollar's strength amid robust economic performance and reduced expectations for Federal Reserve interest rate cuts. Analysts anticipate the dollar's strength to persist, driven by favorable interest rate differentials and economic data. The euro is forecasted to slightly rise over the next year, reflecting contrasting economic conditions and policies between the U.S. and the Eurozone. In the short term, the euro may face resistance around the 1.10 level, with support near 1.0750. A break below this support could target the 1.05 level, a significant support zone in recent years.

XAU/USD

Gold prices have surged to record highs, surpassing $2,700 per ounce, driven by geopolitical tensions, economic uncertainties, and expectations of interest rate cuts. Analysts predict further increases, potentially reaching $2,890 per ounce, with key support levels at $2,605 and $2,530. Investors are turning to gold as a safe haven amidst economic uncertainties, including Middle Eastern conflicts and the upcoming U.S. election. Despite the bullish trend, caution is advised, as potential short-term declines could occur if prices dip below key levels. Overall, gold's rise is seen as a hedge against inflation, lower interest rates, geopolitical risks, and central bank policies.

BTC/USD

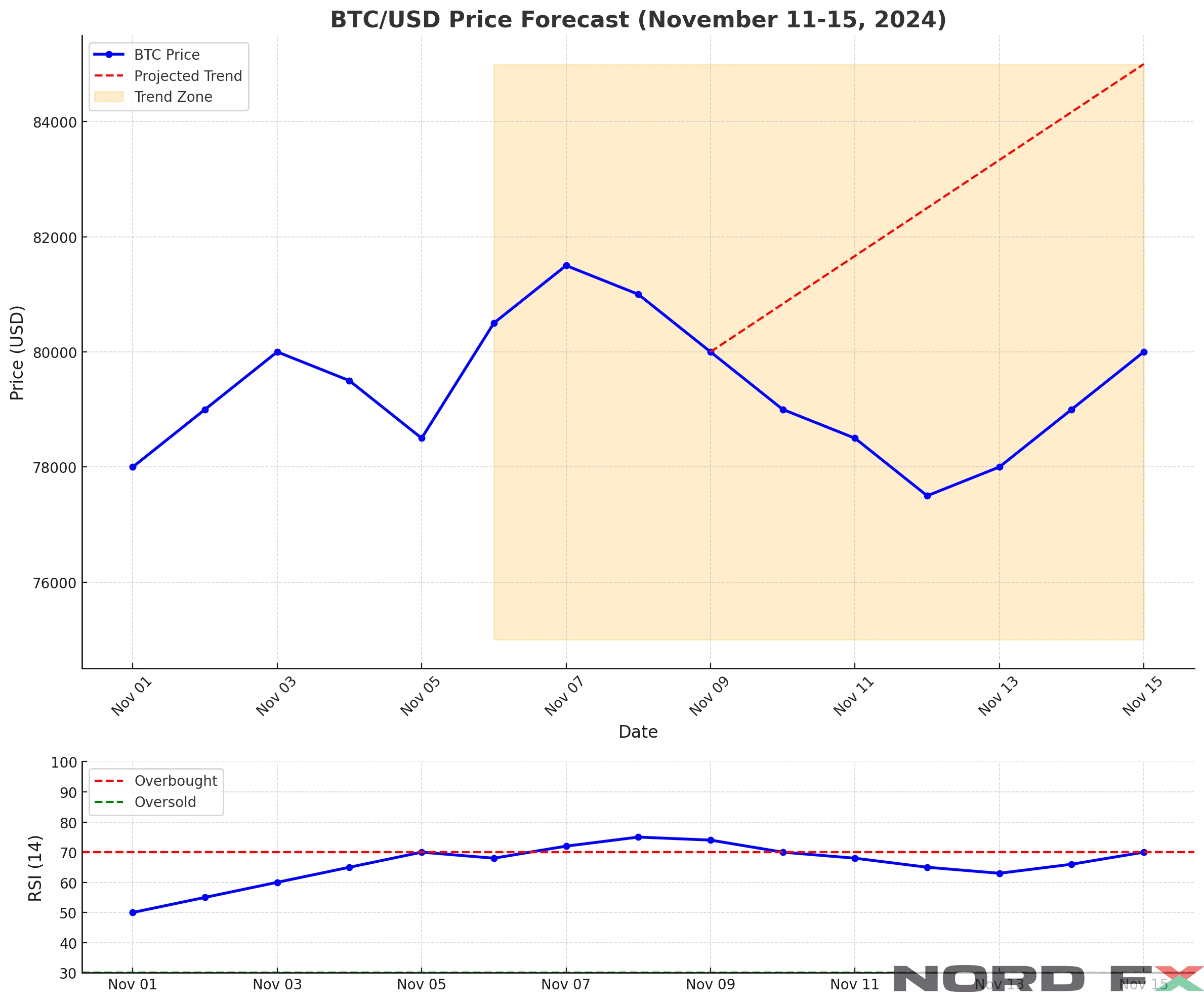

Bitcoin (BTC) recently reached the $80,000 mark, nearing an all-time high and reflecting renewed market confidence. However, signs of profit-taking have emerged, suggesting potential volatility ahead. Analysts believe that Bitcoin might experience a pullback in the coming days, particularly as the market processes the implications of the U.S. presidential election, a critical event shaping the regulatory landscape for cryptocurrencies. If BTC declines and closes below the $78,000 level, it could test the next key support around $75,000, with the breakout zone near $74,500 on the weekly chart. A continued hold above $80,000, however, could drive Bitcoin toward a new high, with the next target being $85,000.

NordFX Analytical Group

Notice: These materials are not investment recommendations or guidelines for working in financial markets and are intended for informational purposes only. Trading in financial markets is risky and can result in a complete loss of deposited funds.

திரும்பிச் செல்லவும் திரும்பிச் செல்லவும்