The past week saw notable market fluctuations across major Forex and cryptocurrency pairs, with the euro weakening against the dollar, gold maintaining its bullish momentum, and bitcoin experiencing downward pressure despite an overall long-term uptrend. Moving into the first full week of March, volatility is expected to persist, driven by macroeconomic indicators, central bank comments, and investor sentiment. The euro is showing signs of a possible rebound, gold is poised to continue its bullish trajectory, and bitcoin faces key support and resistance levels that could define its next major move.

EUR/USD

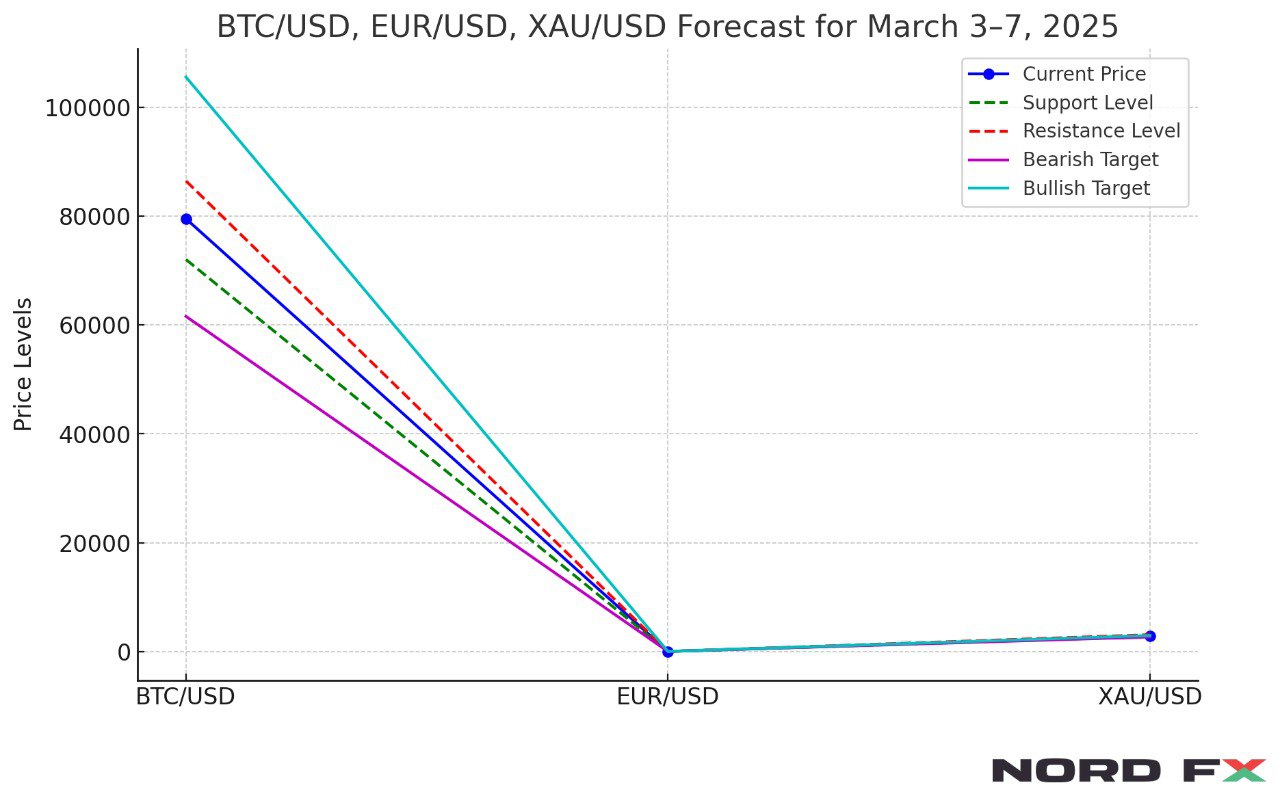

The euro-dollar pair ended the week lower, closing near 1.0387 as it remained within a corrective phase and formed a "Triangle" pattern. Technical indicators suggest a bearish trend, with the price breaking through key moving average signals. Sellers appear to be in control, pointing to a possible continuation of the downtrend. In the coming week, an attempt to test the support zone near 1.0255 is expected, followed by a potential rebound that could push the pair towards the 1.0805 level.

A test of the support line on the Relative Strength Index (RSI) would confirm the likelihood of an upward correction. Additionally, a bounce from the lower boundary of the "Triangle" pattern would reinforce bullish prospects. However, if the pair breaks below 0.9965, the bearish outlook will be confirmed, potentially driving the euro down to 0.9645. A breakout above 1.0645, on the other hand, would signal renewed bullish momentum, indicating a possible breach of the upper boundary of the "Triangle" and setting targets higher.

XAU/USD

Gold remains within a strong bullish trend, with the price continuing to move inside an ascending channel. The breakout above key moving average levels confirms ongoing buying pressure. However, a temporary correction could lead to a test of support near 2835 before prices resume their uptrend. If this scenario plays out, the next upside target lies above 3075.

Further confirmation of gold's bullish continuation would come from an RSI trendline rebound and a bounce from the lower boundary of the channel. Should the price fall and break below 2735, the bullish outlook would be invalidated, signaling a potential decline towards 2665. On the upside, a breakout and close above 2935 would affirm the continuation of the upward movement, keeping gold on track for new highs.

BTC/USD

Bitcoin ended the week at 79,552, staying within a downtrend as it moves towards completing the "Triangle" pattern. While the long-term trend remains upward, the cryptocurrency is currently under selling pressure, as indicated by its break below key moving average signals. A short-term recovery is possible, with an expected test of resistance near 86,505 before renewed downward momentum potentially drives the price towards 61,605.

A confirmation of the bearish scenario would come from a bounce off the lower boundary of the "Triangle" and rejection at the RSI resistance line. If bitcoin manages to break and sustain above 97,045, the bearish outlook would be negated, opening the way for further gains towards 105,605. Conversely, a break below 72,065 would indicate stronger selling pressure and confirm the continuation of the bearish movement.

Conclusion

The upcoming trading week presents a mix of opportunities and risks across Forex and cryptocurrency markets. The euro remains under pressure but could see a recovery if it holds key support levels. Gold continues its bullish momentum, though a short-term correction is likely before further gains. Bitcoin is at a critical juncture, with a possible rebound before a continued decline unless it breaks key resistance. Traders should stay vigilant, monitor economic developments, and prepare for potential volatility in the days ahead.

NordFX Analytical Group

Disclaimer: These materials are not an investment recommendation or a guide for working on financial markets and are for informational purposes only. Trading on financial markets is risky and can lead to a complete loss of deposited funds.