Gold is one of the favourite trading instruments of the most successful traders at NordFX. This can be easily confirmed by looking at the monthly rankings published by this brokerage company. That is why it is appropriate to provide a special review, focusing solely on the XAU/USD pair.

Is Gold Truly a Protective Asset?

In the current economic situation, as leading central banks worldwide attempt to curb inflation, the price of this precious metal has reached a historic high, hitting $2,080 per troy ounce on May 4. Market participants are rushing to buy gold, believing it can safeguard their capital from devaluation.

According to a survey conducted by Bloomberg, approximately 50% of respondents identified gold as their primary safe-haven asset (with US Treasury bonds coming in second place, receiving only 15% of the votes). However, is gold truly an effective tool for hedging price risks, or is this a widespread misconception?

Consider, for instance, the period from March to October 2022 when gold prices fell from $2,070 to $1,616, a decline of almost 22%. This occurred despite the fact that inflation in the United States reached a 40-year peak during that time. So, what kind of protective asset is gold, then?

The Growth of Gold Prices

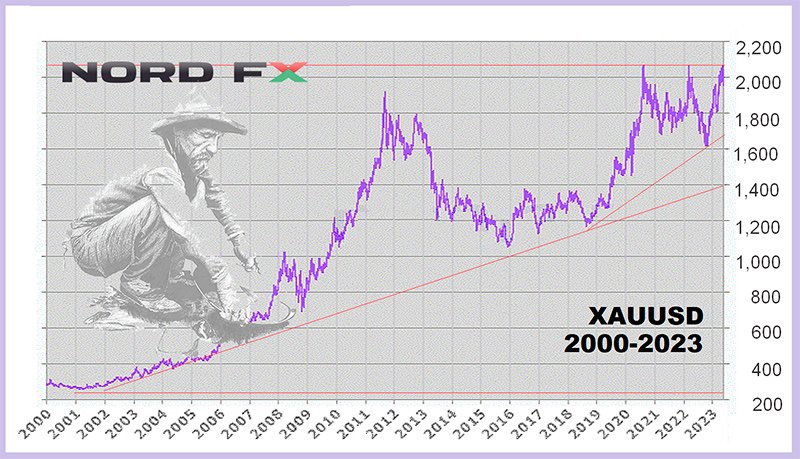

If we trace the dynamics of gold prices since the beginning of the 20th century, we observe the following pattern. In the year 1900, the price of this precious metal was approximately $20 per troy ounce.

During the period from 1914 to 1918, amidst and immediately after World War I, the price rose to around $35. Then, in the 1930s, during the Great Depression and as a result of currency reforms in the United States, the price was set at $20.67 per troy ounce. Throughout World War II, the value of the asset remained stable and was fixed at $35 under the Bretton Woods system, the same level as during World War I.

In 1971, the United States abandoned the gold standard, which led to floating exchange rates and an increase in the price of gold. In the late 1970s and early 1980s, the price exceeded the $800 mark per troy ounce due to geopolitical tensions, inflation, and a reduction in gold production. From the 1980s to the 2000s, the price of gold declined and fluctuated within a range of approximately $250 to $500.

Since the early 2000s, there has been a significant increase in the price of gold due to geopolitical events, financial instability, and inflationary pressures. In August 2020, amidst the COVID-19 pandemic and economic uncertainty, the price of gold surpassed the $2,000 mark per troy ounce for the first time. However, following this peak, it experienced a decline due to expectations of economic recovery, tightening monetary policies by central banks, rising interest rates, and various other factors.

A subsequent unsuccessful attempt to break above the $2,000 resistance level occurred in March 2022. Finally, the third surge occurred in May of this year.

Why Gold Prices Are Rising

So, what contributes to the value of gold and why does its price rise?

- Rarity and Limited Supply: Gold is a rare metal, and its extraction is limited and requires significant efforts and resources.

- Durability and Longevity: Gold is highly resistant to wear and corrosion. It retains its physical properties over time, making it suitable for long-term storage and attractive for use in jewellery and various industries.

- Store of Value: Gold has long been considered a store of value. It can preserve its purchasing power over extended periods, serving as a hedge against inflation and the instability of stocks and currencies.

- Liquidity and Recognizability: Gold is universally recognized and accepted as an asset. It can be easily exchanged for cash or used as a medium of payment in different countries and cultures.

- These factors contribute to the desirability and demand for gold, thus driving its price upward.

Factors Influencing Gold Prices

Let's delve into the factors that influence the price of gold. It's important to note that there is no direct correlation between the price of gold and each of these factors individually. Market forecasts and the combination of these factors also play a role in determining gold prices. For example, the recent surge in XAU/USD can be attributed to expectations of a reversal in the Federal Reserve's interest rate hike cycle, potential U.S. debt default, as well as geopolitical and economic instability due to Russia's armed actions in Ukraine. Now, let's explore the key factors:

- Economic Conditions: The global economic situation, including GDP growth or decline, unemployment, and overall financial stability, can impact gold prices. Uncertainty in the markets or a recession, for instance, may increase demand for gold as a risk-free asset.

- Geopolitical Events: Political and geopolitical events such as armed conflicts, wars, terrorist acts, sanctions, elections, etc., can cause market instability and uncertainty, leading to an increased demand for gold as a safe haven.

- Inflation: The level of inflation plays a crucial role in determining the value of gold. When inflation rises, the price of gold typically follows suit as investors seek protection against the devaluation of money.

- Central Banks: Actions taken by central banks, including changes in interest rates, can influence gold prices. For example, a decrease in interest rates may stimulate demand for gold as holding it becomes comparatively more attractive than other assets.

- Currency Movements: Fluctuations in exchange rates between different countries can also impact the price of gold. If the currency of a gold-producing country weakens against other currencies, the price of gold in that currency may increase, stimulating exports and raising the demand for gold.

- Investment Demand: Investment demand includes the purchase of gold bars, coins, and futures market transactions. Demand typically rises when trust in fiat currencies weakens.

- It's important to consider the interplay of these factors and market expectations when assessing the price of gold.

Forecast: Will the Price of Gold Rise?

When it comes to forecasts, it's important to note that they are mere assumptions based on available information and analysis. As mentioned before, the gold market is complex and subject to the influence of multiple factors. Any forecasts are subjective assessments and can change depending on economic and geopolitical situations, as well as changes in market demand and supply. However, it should be acknowledged that some forecasts have proven to be relatively accurate.

Here are a few examples of such forecasts made before September 2021. In May 2021, analysts at Goldman Sachs predicted that the price of gold would reach $2,000 per troy ounce by 2024. Two months later, their counterparts at Bank of America made the exact same forecast. The touch of this resistance level occurred one year earlier. However, whether XAU/USD will be able to sustainably establish itself above this level, turning it from resistance to support, remains to be seen.

Currently, Goldman Sachs strategists are indicating a target of $2,200. Meanwhile, the Swiss financial holding UBS believes that the price of gold may rise to $2,100 by the end of 2023 and to $2,200 by March 2024. (It's worth noting that their previous forecast projected a peak of $2,400 for this year). Similar figures are mentioned by analysts at the Economic Forecasting Agency, who believe that the price of gold may even exceed $2,400, but this is expected to occur only in 2027.

***

At the beginning of this overview, we raised the question of whether gold is a protective asset. In his early statements, Warren Buffett expressed scepticism about investing in gold, referring to it as an unproductive asset that doesn't generate income. However, looking at the chart, it becomes clear that he was mistaken. Even the legendary investor himself acknowledged this and later expressed a positive attitude towards gold as a store of value. Prominent financier George Soros also recognized gold as a diversification asset that provides protection against inflation and political instability. Ray Dalio, the founder of investment firm Bridgewater Associates, recommended including this precious metal in one's portfolio.

Most likely, they are all correct, and in the foreseeable future, gold will retain its role as a primary capital preserver. However, it is always important to remember that the effectiveness of any investment depends on the entry point. If the timing of a trade is chosen incorrectly, it is possible that your deposit may start to decrease. Nevertheless, in the case of gold, the probability of XAU/USD rising again is significantly higher than that of many fiat currencies. To withstand drawdowns and ultimately achieve profit, sound money management, as well as time and patience, are necessary.

NordFX Analytical Group

Notice: These materials are not investment recommendations or guidelines for working in financial markets and are intended for informational purposes only. Trading in financial markets is risky and can result in a complete loss of deposited funds.

Go Back Go Back