General Outlook

Last week closed with sharp reactions across major markets following a weaker-than-expected US non-farm payrolls report and renewed tariff tensions. The dollar came under pressure as job creation slowed significantly and unemployment ticked higher, fuelling expectations of a policy shift from the Federal Reserve. Meanwhile, risk sentiment weakened, triggering strong gains in traditional safe-haven assets like gold and the euro, while bitcoin pulled back modestly after posting a record monthly close. As the new week begins, all eyes remain on macroeconomic developments and the broader risk environment.

EUR/USD

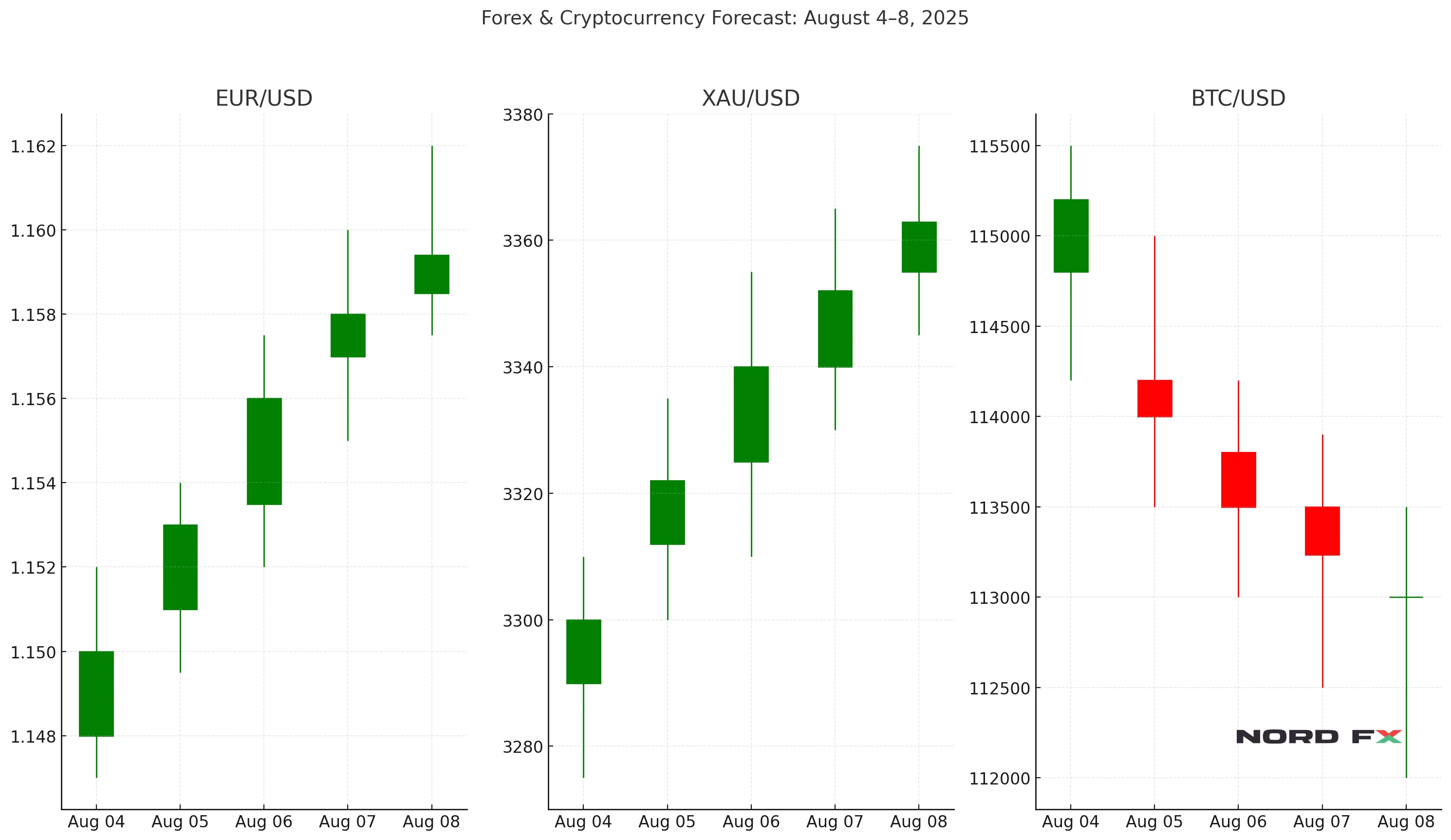

The euro-dollar pair finished the week at approximately 1.1594, gaining strength in the latter part of the week as the dollar slipped. The technical outlook remains constructive, with moving averages supporting the bullish bias. Price action suggests a likely test of resistance in the 1.1715 area in the early part of the week. However, a rejection from that zone could prompt a renewed decline, with downside targets seen below 1.0835. If EUR/USD manages to break above the 1.2055 threshold, the bearish correction scenario would be invalidated, opening the door for further gains toward 1.2365. A daily close below 1.1345, on the other hand, would reinforce a bearish reversal.

XAU/USD (Gold)

Gold ended the week with a firm rally, closing near the 3,362.9 level amid heightened geopolitical tensions and disappointing US economic data. XAU/USD continues to trade within an upward trend, and a bullish breakout remains the favoured scenario if the market stays above key support. A brief correction toward the 3,270–3,275 region may occur, but as long as that support holds, prices are likely to rebound with potential to retest the 3,350 level and possibly extend toward 3,500. A sustained break below 3,244 would negate this bullish view and suggest a deeper move toward 3,200 or even 3,121.

BTC/USD (Bitcoin)

Bitcoin closed July with a record monthly finish around 115,800, but slid slightly to 113,234 by Saturday morning. The pullback reflects typical post-rally profit-taking and growing caution as volatility increases across risk assets. For the week ahead, the critical support zone lies between 113,000 and 114,000. A rebound from this area could fuel another upward leg, with resistance expected at 127,600 and a possible extension to 145,000 if bullish momentum returns. However, a clear break below 113,000 would put pressure on the bulls and could push the price down toward 111,800 or even 104,000.

Conclusion

As August trading begins, markets are navigating a delicate balance between risk aversion and technical momentum. The euro has room to climb but faces resistance ahead. Gold is gaining ground on safe-haven flows, while bitcoin stands at a critical technical juncture following its historic close. Volatility is likely to persist, with upcoming US data and geopolitical headlines setting the tone for price direction in all three key assets.

NordFX Analytical Group

Disclaimer: These materials are not an investment recommendation or a guide for working on financial markets and are for informational purposes only. Trading on financial markets is risky and can lead to a complete loss of deposited funds.

Go Back Go Back