General Outlook of the Past and Coming Week

Markets ended the week in a mixed mood as participants tried to digest both the end of the record 43-day US government shutdown and the growing uncertainty around the Federal Reserve’s next move. The shutdown formally ended on 12 November and federal agencies are now rebuilding the timetable for delayed economic data, which means that October figures for growth, jobs and spending will trickle out with lags and possible gaps. This complicates the Fed’s task at a time when annual US inflation is hovering around 3.0 percent and still above the 2 percent target.

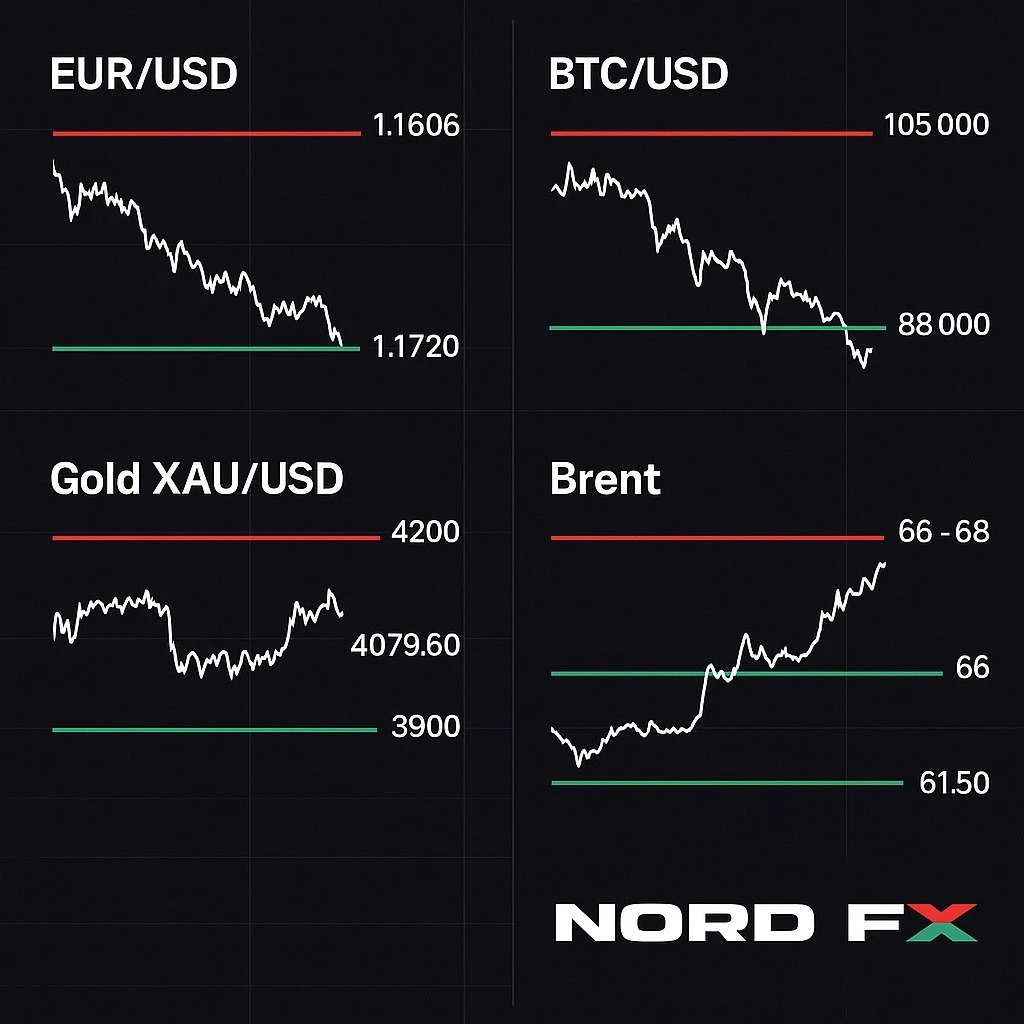

Brent crude futures settled on Friday near US$ 64 per barrel, staying inside a broad descending channel despite a modest recovery from midweek lows. Gold closed the session around US$ 4 079.60 per ounce after trading between roughly US$ 4 032 and US$ 4 212 during the day, remaining not far below its recent all-time highs.

In cryptocurrencies, bitcoin extended its correction from the October peak. The coin fell as low as around US$ 94 000 on Friday and finished the day near US$ 94 500. On Saturday it is trading again close to US$ 96 000, but still more than 10 percent below the highs above US$ 110 000 seen at the end of October.

Looking ahead to the week of 17-21 November, traders will focus on a dense calendar of events. Key items include Canadian CPI on Monday, the minutes of the Fed’s October meeting on Wednesday 19 November, interest rate decisions in Asia and a batch of flash PMI readings for the eurozone, UK and US at the end of the week. With the odds of a further Fed rate cut at the 9-10 December meeting now close to a coin toss, any hint from the minutes or PMIs could trigger sharp moves in the dollar, yields and risk assets.

EUR/USD

EUR/USD closed on Friday at 1.1606 after trading in a 1.1606-1.1654 intraday range and posting only a small weekly loss. On the daily chart, the pair remains above its 50-day moving average and continues to move within a medium-term Triangle pattern that has been forming since late summer. Buyers are still defending the 1.1490-1.1520 support zone, while momentum indicators point to fading upside force as the RSI approaches a descending trend line from the July highs.

In the coming week, a fresh attempt to test resistance in the 1.1720-1.1760 area remains possible if the Fed minutes are interpreted as cautious and if flash PMIs do not show a sharp deterioration in eurozone activity. However, with euro area growth only stabilising, US inflation near 3 percent and Fed officials openly divided on whether another cut in December is needed, a sustained breakout higher will likely require a clearer signal that US policy is turning decisively more dovish.

A break below 1.1490 would expose the 1.1365 region and increase the risk of a deeper correction toward the early October lows. On the other hand, a daily close above 1.2060 would signal a confirmed bullish breakout from the medium-term consolidation and open the way toward the 1.22-1.23 band.

Baseline view: mild bullish bias while EUR/USD remains above 1.1490, with room for a push into the 1.17 zone, but with a significant risk of corrective pullbacks if Fed communication or US data shift sentiment back in favour of the dollar.

Bitcoin (BTC/USD)

bitcoin had another volatile week. After trading above US$ 105 000 at the start of November, the coin has now clearly moved into a corrective phase. On Friday, BTC/USD dropped to around US$ 94 000 before closing near US$ 94 500. On Saturday, it is fluctuating close to US$ 96 000 according to major exchanges, which is still well below the October highs around US$ 125 000-126 000. The move has been driven by cooling ETF demand, reduced expectations of aggressive Fed easing and a wave of profit taking after this year’s powerful rally.

Technically, bitcoin has broken out of its steep bullish channel and is now trading inside a broader downward or corrective channel. Shorter-term moving averages have started to roll over, and the 14-day RSI is stuck below the mid-range, confirming a loss of upside momentum. The nearest resistance now lies in the US$ 102 000-105 000 area, where previous support, the 50-day moving average and a descending trend line roughly converge.

If the price fails to break this zone and sellers regain control, a renewed decline toward US$ 92 000 and then US$ 88 000-85 000 cannot be ruled out, especially if risk appetite deteriorates after the Fed minutes. Conversely, a sustained move back above US$ 115 000 would signal that the correction is likely over and could open the way for another attempt at the October peaks near US$ 125 000-126 000.

Baseline view: neutral-to-bearish while BTC/USD trades below the US$ 102 000-105 000 resistance band and, in particular, below US$ 100 000. Short-term rebounds are possible, but for now they look like corrective rallies rather than the start of a new impulsive uptrend.

Brent Crude Oil

Brent crude futures finished Friday’s session close to US$ 64 per barrel, recovering part of the losses seen earlier in the week but still trading towards the lower half of the range that has dominated since Q2. Prices remain inside a wide descending channel, and sellers appear ready to re-emerge on approaches to the US$ 66-68 area.

The fundamental picture remains mixed. On the one hand, supply concerns periodically flare up due to geopolitical risks and infrastructure incidents, which support prices on days when headlines turn negative. On the other hand, worries about global demand and the impact of still elevated real interest rates keep longer-term bulls in check, with forward curves and positioning data suggesting only cautious confidence in a sustained rebound.

In the short term, a corrective move higher toward US$ 66-67 is possible if sentiment improves and if weekly US inventory data show stronger demand or larger drawdowns. However, a daily close below the US$ 62-61.50 support zone would indicate that bearish pressure is strengthening again and could open the way toward US$ 58 and the lower boundary of the descending channel. Only a sustained advance above US$ 70-71 would clearly indicate that a more durable bullish trend reversal is underway with potential targets closer to US$ 76.

Baseline view: neutral-to-bearish while Brent is trading below roughly US$ 68, with rallies toward resistance more likely to attract selling interest unless incoming macro data point to a stronger recovery in global demand.

Gold (XAU/USD)

Gold futures settled on Friday at about US$ 4 079.60 per ounce, after an intraday range from roughly US$ 4 032 to US$ 4 212. This marked a second consecutive weekly pullback from the recent record zone above US$ 4 300 but left the broader uptrend intact. XAU/USD is still trading inside a wide ascending channel on the daily chart, supported by structurally high real debt burdens, lingering fiscal concerns and demand from investors seeking a hedge against inflation that remains around 3 percent in the US and elevated in many other economies.

Technically, the metal is consolidating above an important support band in the US$ 3 950-3 900 area, where previous breakout levels and the 50-day moving average are clustered. Momentum indicators have eased from overbought territory, allowing the uptrend to cool without yet signalling a major reversal. A deeper dip toward US$ 3 865 cannot be excluded if the dollar extends its recovery or if real yields move higher, but at this stage such declines would more likely be seen as an opportunity to re-enter long positions rather than a clear trend change.

On the upside, confirmation that the correction has run its course would likely come from a daily close back above the US$ 4 165-4 200 resistance zone. In that case, the next targets would be in the US$ 4 250-4 300 range and then the recent all-time highs slightly above US$ 4 380. A collapse and sustained move below US$ 3 535 would be required to invalidate the medium-term bullish scenario and point to a more profound reversal.

Baseline view: buy-the-dip bias while XAU/USD is holding above roughly US$ 3 900, with the next potential leg higher dependent on how the Fed minutes and the delayed US data affect expectations for real interest rates and the dollar.

Conclusion

The week of 17-21 November opens with markets trying to find their bearings after the historic US government shutdown and ahead of crucial central bank signals. The US inflation picture remains uncomfortable, with headline CPI around 3 percent year on year and Fed officials split over whether another rate cut at the 9-10 December meeting is justified. At the same time, the release schedule for October data is being rebuilt, which adds another layer of uncertainty for traders.

In this environment, EUR/USD continues to trade inside a broad range, with neither bulls nor bears able to secure a decisive victory. Gold is pausing after setting fresh records but still looks supported on dips, while Brent remains capped by concerns about global demand. bitcoin, finally, has reminded market participants how sensitive high beta assets are to shifts in interest rate expectations and leverage conditions, dropping sharply from its peak as traders factor in the possibility that December’s Fed decision is no longer a one-way bet.

As always, traders should remain flexible, keep an eye on the key technical levels highlighted above and closely monitor the incoming macro releases, especially the Fed minutes and flash PMIs. Volatility may rise quickly if any of these signals significantly alter expectations for monetary policy or global growth.

NordFX Analytical Group

Disclaimer: These materials are not an investment recommendation or a guide for working on financial markets and are for informational purposes only. Trading on financial markets is risky and can lead to a complete loss of deposited funds.