The second full trading week of 2026 begins with markets refocusing on macroeconomic drivers after the initial post-holiday repositioning. Inflation data, expectations regarding monetary policy, and shifts in global risk sentiment are likely to remain the main catalysts, keeping volatility elevated across FX, commodities, and cryptocurrency markets.

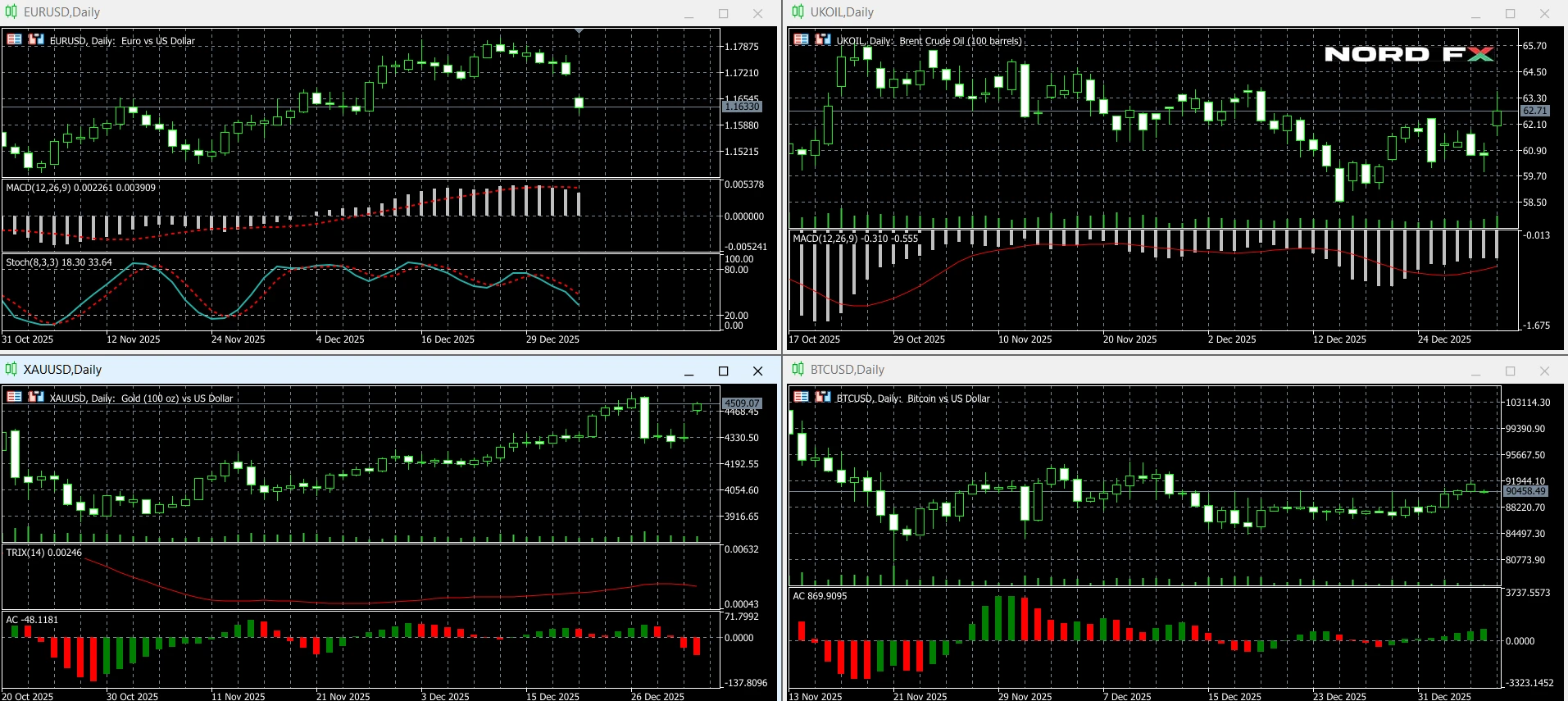

By the close of trading on Friday, January 09, 2026, EUR/USD finished at 1.1638, Brent crude oil at 63.34 USD per barrel, bitcoin (BTC/USD) near 90,630.0, and gold (XAU/USD) at 4,500.90. As of Saturday, January 10, BTC/USD is trading around 90,480.0, indicating that the market remains in consolidation mode after recent volatility.

EUR/USD

EUR/USD closed the week at 1.1638, continuing its pullback from early January highs. The pair remains highly sensitive to US macroeconomic data and shifts in interest rate expectations. At the same time, the euro is struggling to regain upside momentum amid cautious sentiment.

In the coming week, an attempt to recover toward the 1.1680-1.1720 resistance zone cannot be ruled out. Failure to consolidate above this area may trigger renewed selling pressure with a move toward 1.1620-1.1580. A deeper decline toward 1.1520-1.1480 is possible if bearish momentum strengthens.

A confident breakout and consolidation above 1.1720-1.1765 would invalidate the bearish continuation scenario and open the way toward 1.1820-1.1900. Conversely, a breakdown below 1.1580 would confirm a stronger bearish bias.

Baseline view: neutral to mildly bearish while EUR/USD remains below 1.1720, with downside risks increasing if 1.1580 is broken.

Bitcoin (BTC/USD)

Bitcoin ended Friday near 90,630.0 and is trading around 90,480.0 early Saturday. Price action suggests a pause after recent swings, with the 90,000 level acting as a key psychological pivot for market participants.

During the week of January 12-16, BTC/USD may attempt to test resistance in the 91,500-93,500 area. A rejection from this zone could lead to a pullback toward 90,000-89,000, followed by stronger support in the 88,000-86,000 region.

A breakout above 93,500-95,000 would cancel the corrective scenario and signal renewed bullish momentum, opening the way toward 98,000-100,000 and potentially further toward 103,000-106,000.

Baseline view: neutral to slightly bullish while prices remain above 89,000-90,000, with key resistance located at 93,500-95,000.

Brent Crude Oil

Brent crude closed the week at 63.34 USD per barrel, extending its rebound and holding above the 62.00 level. The technical picture suggests an attempt to form a higher base, although the market still faces notable resistance overhead.

In the new trading week, Brent may test the 63.90-65.00 resistance area. From this zone, a corrective pullback toward 62.60-61.80 is possible. If bullish momentum weakens, a deeper decline toward 60.70-59.90 cannot be excluded.

A strong rise and consolidation above 65.00 would invalidate the corrective scenario and open the way toward 66.80-68.00. A breakdown below 61.80 would shift the outlook back to bearish, with focus returning to the 60.70-59.00 area.

Baseline view: neutral to mildly bullish while Brent remains above 61.80-62.60, with 63.90-65.00 acting as key resistance.

Gold (XAU/USD)

Gold closed Friday at 4,500.90, remaining near recent highs and continuing to benefit from sustained safe-haven demand. Despite strong medium-term fundamentals, short-term volatility may increase around key macroeconomic releases.

In the coming week, a corrective pullback toward 4,480-4,450 is possible, followed by renewed attempts to rise toward 4,520-4,560. A breakout above 4,560 would open the way toward 4,600-4,680.

A decline and consolidation below 4,450-4,410 would invalidate the bullish continuation scenario and signal the risk of a deeper correction toward 4,350-4,300.

Baseline view: buy on dips while gold remains above 4,450, with upside potential preserved.

Conclusion

The trading week of January 12-16, 2026 is likely to remain driven by inflation expectations, monetary policy signals, and shifts in global risk appetite. EUR/USD remains vulnerable below key resistance levels and may trade with a bearish bias. Bitcoin continues to consolidate near 90,000, awaiting a breakout to define the next directional move. Brent crude is attempting to stabilise but still faces strong resistance. Gold remains structurally bullish, with corrective dips likely to attract renewed buying interest.

NordFX Analytical Group

Disclaimer: These materials are not an investment recommendation or a guide for working on financial markets and are for informational purposes only. Trading on financial markets is risky and can lead to a complete loss of deposited funds.