Gold offers some of the cleanest price movements in the Forex/CFD market. Its liquidity, volatility, and strong reaction to economic news make it ideal for trader-focused strategies. This article explains the three most common approaches to XAUUSD: day trading, swing trading, and trend following. In our broader Gold Trading Guide: How to Trade XAUUSD Step by Step, these form the core skill set needed for building a structured approach to the market.

Gold trading strategies vary based on time horizon, volatility expectations, and risk tolerance. The sections below explain how each method works, how to create rules around it, and how to apply practical examples. For supporting knowledge, you can also explore Gold Trading Basics: How to Trade XAUUSD Step by Step on MT4/MT5, and for fundamentals see Fundamental Drivers and Economic News that Move Gold (XAUUSD).

A quick summary: Gold trading strategies such as day trading, swing trading and trend following on XAUUSD use time-based and momentum-based rules to capture intraday moves, short-term price swings, or longer-term trends. Each strategy requires discipline, clear entry criteria, risk management, and awareness of economic news.

Key points:

- Day trading focuses on 5-minute to 30-minute charts and high-volatility periods.

- Swing trading holds positions for several days based on price swings between support and resistance.

- Trend following uses higher timeframes (H4–D1) and aims to stay with major gold trends.

- Strategy selection depends on volatility, time availability, and risk tolerance.

- Risk control on gold is essential due to fast price movements and sudden spikes. Explore Risk Management for Trading Gold: Position Sizing and Volatility Control.

Understanding Gold’s Price Behaviour and Volatility

Gold is a momentum-driven market with periods of calm consolidation interrupted by sharp directional moves. These moves often occur around economic events such as US CPI, NFP, FOMC meetings, and geopolitical headlines. In day trading strategies, volatility is a tool; in swing trading, it defines the range; in trend following, it confirms momentum direction.

Gold also reacts strongly to USD strength, Treasury yields, and general risk sentiment. These relationships do not need to be predicted perfectly, but understanding them helps choose the most suitable strategy on any given day.

An important practical point: gold can move $10–$30 within minutes on major news releases. Any strategy must therefore incorporate volatility filters and clear rules for reducing risk before data announcements.

Day Trading XAUUSD: Fast Moves, Tight Rules

Day trading gold means entering and closing trades within the same day, usually during the most active market sessions. The focus is short-term price patterns, liquidity pockets, breakouts, and pullbacks. This style suits traders who can monitor the market actively for short periods.

When is day trading gold most effective?

Day trading works best during high-volatility times:

London session open

New York session open

Overlaps between London and New York

US economic news releases

For more on optimal sessions, see Best Time to Trade Gold (XAUUSD): Sessions, Volatility and News.

Typical indicators for gold day trading

While indicators are optional, traders often use:

20–50 EMA for intraday direction

RSI for spotting short-term exhaustion

ATR for intraday range measurements

VWAP for institutional-level reference points

A simple day trading strategy example

This example uses EMA pullbacks.

- Chart: 5-minute or 15-minute.

- Trend filter: Price above the 20 EMA and 50 EMA.

- Entry: Wait for a pullback into the EMAs after a strong impulse candle.

- Signal: Bullish candlestick confirmation or break of recent minor high.

- Stop-loss: Below pullback low (typically $2–$4 depending on volatility).

- Take-profit: 1:1.5 or 1:2 reward-to-risk, or exit near next intraday resistance.

Pros and cons of day trading gold

Pros | Cons |

Frequent opportunities | Requires full focus |

Quick feedback and learning | Sudden news spikes |

Smaller stops possible | Emotional pressure |

No overnight risk | Easy to overtrade |

Key mistakes to avoid in day trading

- Trading during low-volatility Asian sessions (unless using range strategies).

- Entering right before major news events.

- Using tight stop-losses that do not match gold’s natural volatility.

- Overreacting to small intraday pullbacks.

Swing Trading XAUUSD: Capturing Multi-Day Moves

Swing trading aims to capture movements from one technical level to another over several days. This style suits traders who cannot monitor charts constantly but still want active trading opportunities.

What does a swing setup look like?

Swing setups are based on larger cycles of buying and selling. Examples include:

Reversals at key support or resistance zones

Channel bounces

Break-and-retest structures

Fibonacci retracements (38.2%, 50%, 61.8%)

Swing traders often use H1, H4, and D1 charts to spot setups and manage positions.

A simple swing trading example

Here is a classic break-and-retest structure:

- Gold breaks through a resistance at $2,250.

- After the breakout, price pulls back toward the same level.

- You wait for rejection (e.g., long wick candles or bullish engulfing).

- Entry: At confirmation of buyers returning.

- Stop-loss: Below the retest low ($8–$12 depending on timeframe).

- Targets: Next resistance or a fixed 1:2 or 1:3 R:R.

Analysis tools that support swing trading

- Daily pivot levels

- Price action structures (double tops/bottoms)

- Trendlines and channels

- Fibonacci retracement zones

- Higher-timeframe support/resistance clusters

Pros and cons of swing trading gold

Pros | Cons |

Less screen time needed | Overnight gaps or news can affect trades |

Larger reward potential | Requires stronger patience |

Clear technical structures | Wider stops compared to day trading |

Common mistakes in swing trading

Entering too early before a level is confirmed.

Holding positions during major economic events without adjusting risk.

Trading every small pullback instead of waiting for clean structures.

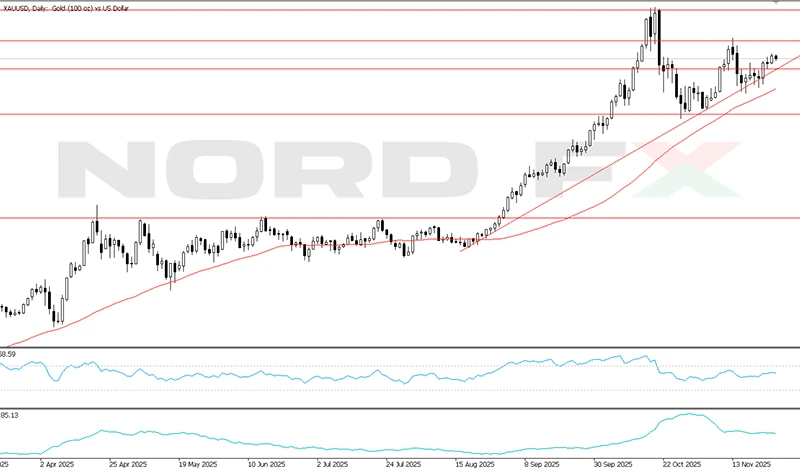

Trend Following on XAUUSD: Staying with the Big Direction

Trend following is based on the idea that strong market movements tend to continue. Gold often forms long-lasting directional trends driven by macroeconomic conditions, making it well-suited for trend strategies.

Recognizing a gold trend

You can identify a trend through:

Higher highs and higher lows (uptrend)

Lower lows and lower highs (downtrend)

EMAs aligned in the same direction

Price breaking through significant levels and holding above/below them

Trend-following traders usually rely on H4 or D1 charts, sometimes even weekly charts for major context.

A simple moving-average trend strategy

- Use 50 EMA and 200 EMA on H4.

- Uptrend: 50 EMA above 200 EMA and price respecting the moving averages.

- Entry: Buy when price pulls back near the 50 EMA and forms bullish confirmation.

- Stop-loss: Below the swing low.

- Take-profit: Trailing stop based on ATR or previous swing highs.

Pros and cons of trend following

Pros | Cons |

Captures large movements | Requires patience for entries |

Fewer trades needed | Can suffer during sideways markets |

Works well on gold’s major trends | Large drawdowns possible |

Typical mistakes trend traders make

Trading inside consolidation zones.

Using tight stops on higher timeframes.

Fighting the dominant trend with counter-trend trades.

Choosing the Right Gold Trading Strategy for You

Selecting a strategy depends on your goals, time availability, and personality.

Time availability

Very little time: Consider trend following.

1–2 trading sessions daily: Swing trading.

Multiple hours available: Day trading.

Risk tolerance

Gold can move quickly; not all trading styles suit every trader.

Risk-averse traders may prefer trend following with wide stops.

Short-term traders comfortable with volatility may prefer day trading.

Balanced traders often choose swing trading.

Chart preference

If you dislike noisy lower timeframes, avoid day trading.

If you prefer clean patterns, swing trading may be suitable.

If you like big-picture macro stories, trend following fits well.

Tools and Indicators That Support All Three Strategies

Even though strategies differ, several tools can enhance any XAUUSD method.

ATR (Average True Range)

ATR shows how much gold typically moves.

In day trading, it helps determine intraday expectation.

In swing trading, it guides stop-loss sizing.

In trend following, it assists with trailing stops.

Support and Resistance

Clear levels matter in all gold strategies due to gold’s tendency to react sharply to levels.

Candlestick Patterns

Useful confirmations include:

Inside bars

Reversal wicks on key levels

Multi-timeframe analysis

Example workflow:

Use D1 to define trend.

Use H4 for structure.

Use M15 or M5 for execution (if day trading).

Strategy Adjustments for High-Volatility Conditions

Gold becomes extremely volatile around major US economic releases.

Examples include:

FOMC

NFP

CPI

Fed speeches

Unexpected geopolitical developments

How to adapt strategies

Reduce lot size before news.

Use wider stops and smaller exposure.

Wait for post-news structure before entering.

Avoid breakout trades right before major announcements.

Trend-following traders often benefit from these events because they may strengthen or reverse macro trends. Day traders must be especially cautious.

Building a Trading Plan for Gold

A structured trading plan improves consistency and helps avoid emotional decisions.

Components of a gold trading plan

- Strategy rules (entry, exit, filters).

- Time availability and trading sessions.

- Risk rules: max loss per trade, max daily loss, stop-loss method.

- List of economic events that impact gold.

- Conditions to avoid (e.g., low-volume Asian session for breakout trades).

- Review and journaling process.

Example trade journal fields

- Date/time

- Strategy type

- Reason for entry

- Stop-loss and target

- Outcome in R:R

- Emotional state

- Lessons learned

A journal helps refine strategy performance, especially if you trade multiple styles.

Combining Day, Swing, and Trend Strategies

Some traders use all three methods but only in specific contexts. For example:

Use trend following as the main bias.

Execute swing trades within the direction of the major trend.

Day trade during strong intraday momentum aligned with the trend.

Benefits of combining strategies

More flexibility

Ability to trade different volatility conditions

Diversification of trade frequency

Risks of combining strategies

Confusion if rules are not clear

Overtrading

Mixed signals from different timeframes

To avoid these issues, maintain separate rules for each strategy and clearly define when you will apply each method.

Risk Management for All Gold Trading Strategies

Because gold is highly volatile, risk management is not optional. A spike of $5–$10 can hit stops quickly if sizing is not adjusted.

To learn more, refer to Risk Management for Trading Gold: Position Sizing and Volatility Control.

Basic risk principles for XAUUSD

- Risk a fixed percentage per trade (e.g., 0.5–1%).

- Adjust lot size based on the distance to stop-loss.

- Avoid trading during unpredictable high-impact events unless you specialize in news trading.

- Use limit orders with clear stop-loss placement, never rely on mental stops.

Example of position sizing

If your account risk per trade is $50 and your stop-loss is $5 away:

Position size = $50 / $5 = 0.10 lots (example CFD contract).

FAQs

What is the best gold trading strategy for beginners?

Beginners often find swing trading easier because it avoids intraday noise and does not require constant screen time. Swing levels on XAUUSD are clearer, and risk can be managed with wider, calmer stop placements. Day trading is typically more demanding, while trend following requires patience and slow decision-making.

Can I day trade gold during all sessions?

Gold can be traded anytime, but liquidity and volatility vary. The London and New York sessions create most of the high-quality moves for day trading. Asian session movements are often smaller and choppier unless reacting to major news. Reviewing volatility patterns helps refine your timing.

How big should my stop-loss be on XAUUSD?

Stop-loss size depends on timeframe and volatility. On M15 charts, stops may range $2–$5; on H1 or H4, stops can be $5–$15. Using ATR helps match stops to current volatility, avoiding stops that are too tight for gold’s behaviour. Ensure proper position sizing when using wider stops.

How do I avoid false breakouts on gold?

Wait for confirmation such as retests, candle closes beyond the level, or volume spikes. Gold is known for wick-heavy behavior around key prices. Using structure confirmation reduces the chance of entering too early. Higher-timeframe context also improves reliability.

Should I hold gold trades during major economic news?

Holding trades during news like CPI or NFP increases risk because gold can move $20–$30 quickly. Some traders reduce position sizes, hedge, or close positions before news. Others wait until post-news structure forms before entering. Your approach should match your risk tolerance.

Can I combine technical and fundamental analysis in gold trading?

Yes. Many traders use fundamentals for trend direction and technicals for entries. For example, if fundamentals suggest bullish conditions for gold, traders may focus on buying pullbacks. Combining both can improve probability, provided the strategy remains structured.

How do I know if the gold market is trending or ranging?

Higher highs and higher lows indicate trending conditions. Flat support and resistance levels indicate a range. EMAs aligned directionally also show trend strength. When gold ranges, trend strategies perform poorly, while swing strategies often work better.

This is not trading advice and is provided for educational purposes only.